Atal Pension Yojana :- Everyone wants to live peacefully in their old age without worrying about money, but for a lot of people who work in small jobs or in the unorganised sector, like daily wage workers, house helps, drivers, or street vendors, there is no regular and fixed income for them after retirement. So, while keeping this in mind and to help such people, the government started a scheme called the Atal Pension Yojana.

Through this, people can save a small amount every month and get a fixed pension after turning 60. How to it works and how to get the benefits of this scheme, how to use the Atal Pension Yojana calculator to know more about the same, keep reading this article.

Contents

- 1 What is Atal Pension Yojana?

- 1.1 The Objective of Atal Pension Yojana Calculator

- 1.1.1 How to Calculate Interest Return Under Atal Pension Yojana?

- 1.1.2 Benefits of Atal Pension Yojana Calculator

- 1.1.3 Eligibility Criteria

- 1.1.4 Helpful Summary of Atal Pension Yojana Calculator

- 1.1.5 APY Chart

- 1.1.6 Atal Pension Yojana Calculator

- 1.1.7 Download Registration Form

- 1.1.8 Required Documents

- 1.1.9 FAQs

- 1.1 The Objective of Atal Pension Yojana Calculator

What is Atal Pension Yojana?

Atal Pension Yojana, or APY, is a pension scheme started by the Government of India in 2015. It is mainly aimed at workers in the unorganized sector. Under this scheme, eligible people can get a fixed monthly pension of Rs1,000, Rs2,000, Rs3,000, Rs4,000, or Rs5,000 after they turn 60 years old. The pension amount depends on how much you contribute monthly and at what age you start the scheme. So in short, based on your age you will pay a small amount every month until you turn 60, After that, you’ll receive the selected pension for the rest of your life.

The Objective of Atal Pension Yojana Calculator

- The Atal Pension Yojana Calculator is a simple online tool that helps you to know:

- That How much Monthly contribution you should and need to make.

- And also, it will help you to know What pension you will receive after the age of 60.

- And your total investment amount

- Also, if you are eligible, it will show government co-contribution too.

- This tool will help you to plan your savings in a better way and also to understand how this scheme will benefit you in the long term.

How to Calculate Interest Return Under Atal Pension Yojana?

- So, Atal Pension Yojana does not provide interest like a bank FD or savings account. Instead of this, you contribute a fixed amount every month, and in return the government gives you assurance of a fixed pension based on your age and monthly contribution.

- Let’s understand this with an example:

- If you are 25 years old and want a pension of ₹5,000 per month, you will need to contribute around ₹376 per month until you turn 60.

- The APY calculator shows how much you need to pay based on your age and desired pension.

Benefits of Atal Pension Yojana Calculator

- It is easy to use, just select your age and the pension amount you want.

- You will get quick results; you will get to know your monthly contribution in seconds.

- It is basically a planning tool; it will help you plan your retirement savings in a better way.

- It also shows Government Contribution Information as it shows if you’re eligible for a co-contribution from the government.

Eligibility Criteria

- You must be an Indian citizen.

- You must be between 18 and 40 years old.

- You should have a savings bank account

- You should not be paying income tax (if you want govt. contribution too)

Helpful Summary of Atal Pension Yojana Calculator

| Age | Monthly Contribution (for ₹5,000 pension) | Total Contribution (approx.) | Monthly Pension after 60 |

| 20 | Rs218 | Rs1,06,640 | Rs5,000 |

| 25 | Rs376 | Rs1,57,920 | Rs5,000 |

| 30 | Rs577 | Rs2,01,720 | Rs5,000 |

| 35 | Rs902 | Rs2,16,480 | Rs5,000 |

| 40 | Rs1,454 | Rs2,60,000+ | Rs5,000 |

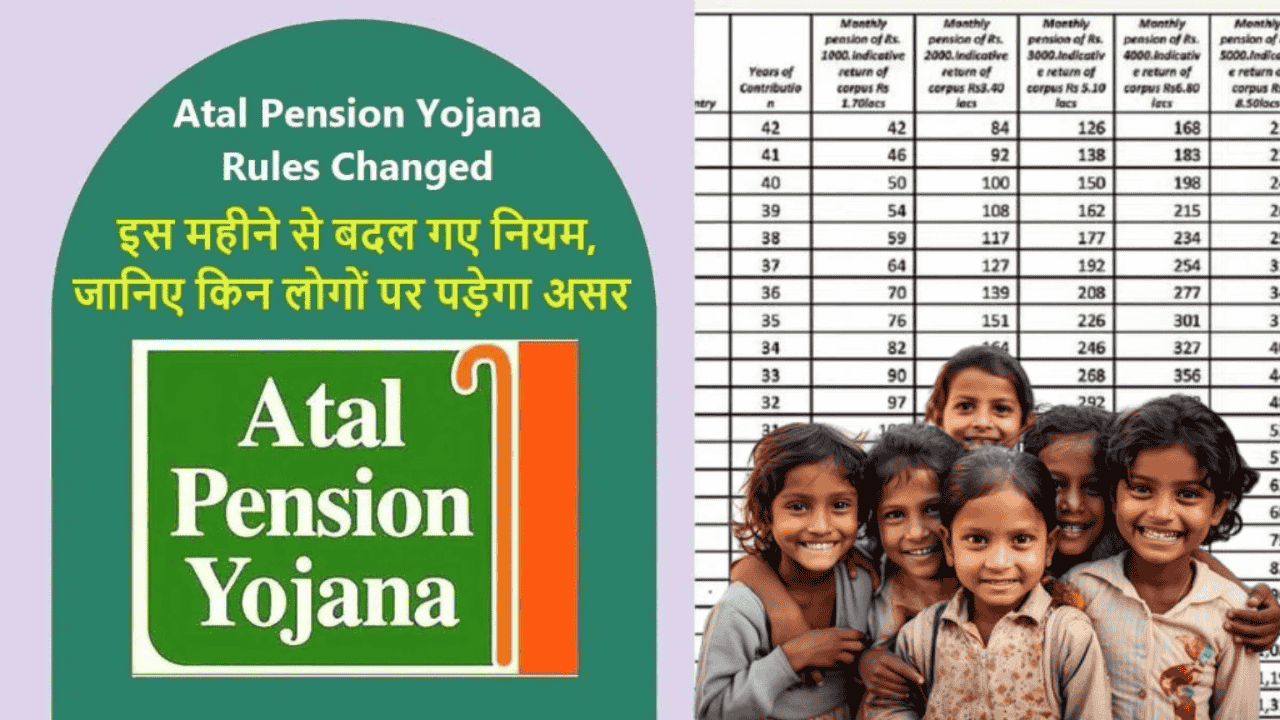

APY Chart

| Age | Rs1,000 | Rs2,000 | Rs3,000 | Rs4,000 | Rs5,000 |

| 20 | Rs42 | Rs84 | Rs126 | Rs168 | Rs210 |

| 25 | Rs76 | Rs151 | Rs226 | Rs301 | Rs376 |

| 30 | Rs116 | Rs231 | Rs347 | Rs462 | Rs577 |

| 35 | Rs181 | Rs362 | Rs543 | Rs722 | Rs902 |

| 40 | Rs291 | Rs582 | Rs873 | Rs1,154 | Rs1,454 |

Atal Pension Yojana Calculator

- You can use the APY calculator for free on:

- SBI or other bank websites

- NPS Trust site: https://npscra.nsdl.co.in

- Post Office official portals

- You just enter your age and pension amount

Download Registration Form

- You can get the APY registration form from:

- Your bank branch

- The official website of your bank

- Government websites like https://npscra.nsdl.co.in

- After filling the form, submit it to your bank. They will help you for the rest so that the amount is deducted every month automatically.

Required Documents

- Aadhar Card

- Age proof

- Mobile number

- Active savings bank account

FAQs

Is the pension guaranteed?

Yes. The government guarantees the pension amount chosen by you.

Is there tax benefit for APY?

Yes, contributions to APY are eligible for tax deduction

Can I exit from APY before 60?

Only in case of death or terminal illness. Otherwise, you have to continue till 60.

Khushi Singh

Khushi Singh is a content writer with 3 years of experience in government schemes. She writes simple and helpful articles that guide people to understand and benefit from public welfare programs.